Where Numbers Become Worlds

We don't just play with money — we live through simulations.

The financial world is no longer locked inside spreadsheets or Wall Street towers. Today, it's also gamified, visualized, and experienced — inside economic strategy games, market simulations, and financial survival narratives. At financexu.space, we explore the evolution of finance as gameplay — dissecting titles that teach, provoke, simulate collapse, and encourage risk. We are not here to sell apps. We are here to understand the ideologies behind income mechanics, to decode the psychology of simulated markets, and to map how these systems shape the way we think about wealth, debt, and survival.

This is not a place for investment advice. It's a chronicle of economic imagination — in pixels, in play, and in paradox.

Feature Article: The Currency of Collapse

The Day The Coin Crashed (Inside 'Wealth & Wreckage')

How one in-game recession turned into a player-led IMF experiment.

In the 2023 strategy title Wealth & Wreckage, developers built an

impressively realistic economic sandbox — complete with

inflationary loops, black markets, and regional currencies. But

they didn't expect what happened in Season 3.

After a small

tweak in the tax algorithm, a player-created alliance artificially

inflated the price of a core resource — "Energy Bonds." Within

days, players began hoarding, dumping, and manipulating rates

through side trades. The market collapsed. In response, a

different group created their own "financial rescue protocol": a

structured lending fund backed by virtual security tokens.

For two weeks, the entire server ran like a shadow central

bank system, with forums filled with terms like "liquidity

provisioning," "speculative arbitrage," and "bond trust dynamics."

The developers didn't interfere. They added a statue to the rescue

team.

This wasn't a bug. It was a social lesson in fiat

fragility, baked into a game.And the players proved more adaptive

than anyone predicted.

In the 2023 strategy title Wealth & Wreckage, developers built an

impressively realistic economic sandbox — complete with

inflationary loops, black markets, and regional currencies. But

they didn't expect what happened in Season 3.

After a small

tweak in the tax algorithm, a player-created alliance artificially

inflated the price of a core resource — "Energy Bonds." Within

days, players began hoarding, dumping, and manipulating rates

through side trades. The market collapsed. In response, a

different group created their own "financial rescue protocol": a

structured lending fund backed by virtual security tokens.

For two weeks, the entire server ran like a shadow central

bank system, with forums filled with terms like "liquidity

provisioning," "speculative arbitrage," and "bond trust dynamics."

The developers didn't interfere. They added a statue to the

rescue team.

This wasn't a bug. It was a social lesson in

fiat fragility, baked into a game.

And the players proved

more adaptive than anyone predicted.

Comparative Analysis: Strategy vs. Simulation

Gaming Wealth: Do Tycoons Teach, or Merely Reward?

Comparing 3 genres of financial gameplay — and what they teach us about control.

Comparing 3 genres of financial

gameplay — and what they teach

us about control.

Not all finance games are created equal. Some prioritize optimizing wealth. Others simulate real financial constraints. Still others simply gamify spending into gratification loops. We reflect on the hidden values behind each mechanic. When a game rewards you for firing workers to increase margin — is it critiquing capitalism, or training you for it? In this article, we dissect:

-

Idle Money Games (e.g. Cash Clicker Pro, Billionaire Blaster):

These offer dopamine-driven financial escalation but little real strategy. Great for behavioral study, weak on realism.

-

City-Building & Trade Systems (e.g. Banished, Anno 1800):

Teach resource scarcity, delayed ROI, taxation tensions, and logistical trade-offs. Excellent for macroeconomic understanding.

-

Stock & Market Sims (e.g. Wall Street Ninja, EconomyCraft):

Range from cartoonish to shockingly accurate. When simulated greed meets cold math, players confront ethics.

Timeline Feature: Financial Histories in Games

From Pixels to Portfolios: A Timeline of Financial Gaming

Tracing the evolution of financial mechanics in video games from 1982 to 2025.

-

1982

Millionaire (TRS-80) launches: players buy and sell commodities in a text interface. Simple, brutal, and educational.

-

1994

Capitalism II arrives. Called "the most realistic business simulator ever made," it's used in university classrooms.

-

2002

The Shady Broker gamifies market manipulation and ethical gray areas. Controversial, but unforgettable.

-

2015

Millionaire (TRS-80) launches: players buy and sell commodities in a text interface. Simple, brutal, and educational.

-

2021- 2024

The rise of DeFi games. Blockchain-backed simulations allow real tokens to flow through game economies. Players profit — or lose — with real-world implications.

-

2025

DustBankers launches on Steam: combines PvP currency wars with a social credit system. Currently under heavy academic review.

Games reflect not just entertainment — but ideological experiments about value.

Psychological Profile: Playing With Debt

The Debt Loop: Why Players Take Loans They Don't Need

Behavioral patterns in financial games reveal uncomfortable truths about power, trust, and pressure.

In many economic sims, players are given the option to borrow virtual funds early — with abstracted or delayed consequences. Yet studies and in-game data reveal an odd truth: players often borrow even when they don't need to. Why?

Our analysis, drawn from CapitalForge, CityBanker '34, and Debt Spiral, shows:

-

Players associate debt with momentum. They feel "stuck" without leverage.

-

Players rarely read interest terms. If there's a glowing loan button, they'll press it.

-

Even simulated money triggers real-world status anxiety. Players avoid being seen as "low score" in multiplayer economies.

When mechanics mirror real capitalism too closely, players

behave in ways that reveal latent fears and desires — about

control, dignity, and the illusion of progress.

And in

games, unlike life, bankruptcy can be restarted.

Or can

it?

interviews

Voices of the System: Developers on Designing Financial Pressure

How game designers walk the line between mechanic and morality.

Behind every in-game economy lies a set of choices — some philosophical, some practical. These games don't just simulate profit. They simulate stress, ethics, and decision-making under systemic tension. We asked three developers known for building financial simulations: "What are you really teaching players when you make them choose between layoffs and survival?"

-

"We never set out to reward cruelty. But the system behaves like real capital — and that's often ugly. When players fire their entire staff to save the quarter, we let them feel it. Sometimes, we log emotional response rates."

Mara Feldman, Lead Designer

- CapitalForge -

"Every number in our game is tied to a cause. Inflation isn't just math — it's war, politics, and fear. We had players destabilize whole economies just to experiment with black market effects. We didn't expect that."

Emil Radu, Economy Architect

- Trade Siege 4 -

"Our game is about intergenerational wealth traps. We let players refinance... but it's a trap. The goal is to make them feel the emotional weight of being stuck."

Tiana Xu, Co-founder

- Debt Spiral

Glossary of Simulated Wealth

The Financexu Glossary: From Margins to Mayhem

Key terms and economic systems often misunderstood by players — and sometimes by devs.

We maintain an evolving glossary of economic concepts that appear in finance-based games — some accurate, some twisted for narrative effect. Understanding these terms transforms gameplay from instinctual to philosophically aware.

-

Deflation Spiral:

A decrease in prices leading to decreased production and increased unemployment. In games, often shown as sudden stagnation mechanics.

-

Liquidity Trap:

A situation where cash is abundant but unused. Appears in idle games that flood players with money they can't reinvest.

-

Speculative Arbitrage:

Buying in one market to sell in another, exploiting differences. Common in multiplayer trade systems.

-

Shadow Currency:

An unofficial or player-created medium of exchange. Often unacknowledged by devs — but wildly powerful.

-

Moral Hazard:

When one takes on risk knowing others bear the cost. Often built into loan mechanics or bailout systems.

-

Hyperinflation Events:

Used in endgame scenarios, often breaking entire economies. Sometimes triggered by exploiters, sometimes by design.

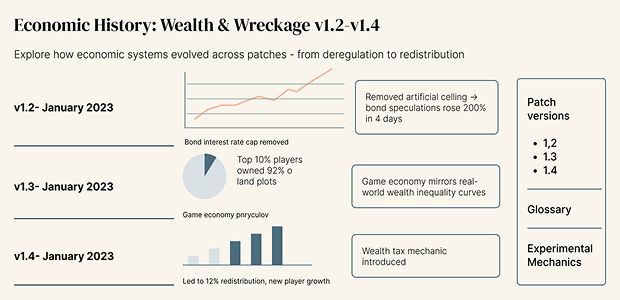

Archive Tools: Track a Game's Economy Over Time

The Mechanics Memory: Interactive Economic Histories of Games

Every update tells a story. Every system leaves a trace.

This block introduces a long-term archive section (for designers): each game reviewed on financexu.space will include an interactive economic map — a visual breakdown of how its internal financial systems changed over time.

What's included:

-

Key patch history focused only on economy-related mechanics

-

Notes on player exploitation trends and how devs responded

-

Taxation / Loan / Asset Price logs from simulation stages

-

Comparative player earnings between versions

-

Data from modded servers, if publicly available

These interactive diagrams aim to chronicle the life and death of virtual economies — as if they were real-world nations.

Example snapshot:

Submit a Theory

What If the System Was Designed to Fail?

Submit your own theory, event, or paradox from a financial game you played.

What's included:

-

Was a loan mechanic too generous — on purpose?

-

Did inflation make the rich stronger, not weaker?

-

Did you discover a way to freeze the market for everyone but yourself?

You don't need to know code. Just describe what happened.

Some of our most insightful articles began with a message

like:

"I think the game was rewarding bankruptcy. Here's

why..."

Your submission might become part of our archives,

glossary, or even trigger a full-feature analysis. Because the

most important mechanic… might be the one no one is talking

about.